New industry landscape: Global demand exceeds 45 billion square meters, with China contributing 35% of the increase

The woven bag industry is undergoing structural transformation in 2025. According to the latest industry report, the global demand for polypropylene plastic woven bags has climbed to 45 billion square meters, with a compound annual growth rate of 8.7%. Among them, China, as the largest producer and consumer, accounts for 35% of the global demand and is expected to exceed 16 billion square meters within the year. This growth is mainly driven by multiple factors such as food security guarantee, accelerated infrastructure construction and expansion of e-commerce logistics. The East China and South China regions remain the core consumption areas in the country, and the demand potential in the central and western regions is accelerating its release.

Policy-driven green transformation: The proportion of orders for degradable products has doubled

Environmental protection policies have become the core driving force for industry transformation. Since the implementation of the “Opinions on Further Strengthening the Governance of Plastic Pollution” issued by the National Development and Reform Commission, the proportion of domestic production capacity adopting environmental protection technologies has risen to 68%, while the European Union, through its Circular Economy Action plan, requires that the proportion of imported packaging recycled materials be no less than 50%. The policy effect is directly reflected in the market end: Enterprises in Zhejiang, Jiangsu and other places have reported that the proportion of orders for eco-friendly woven bags has jumped from 20% last year to 45%. Degradable products such as corn starch-based and PLA composite are in short supply. Although the prices of these products certified by the EU EN13432 are 40-60% higher than those of traditional products, they still achieve an annual growth rate of 12.3%.

Triple technological breakthroughs: Comprehensive upgrades in materials, processes, and intelligence

Technological innovation in the industry is flourishing in multiple areas:

Nano-reinforcement technology has increased the product’s tear resistance by 40%, and graphene-modified materials have been applied in high-end industrial packaging. The penetration rate of new materials such as bio-based polyethylene and recycled polypropylene has exceeded 15%.

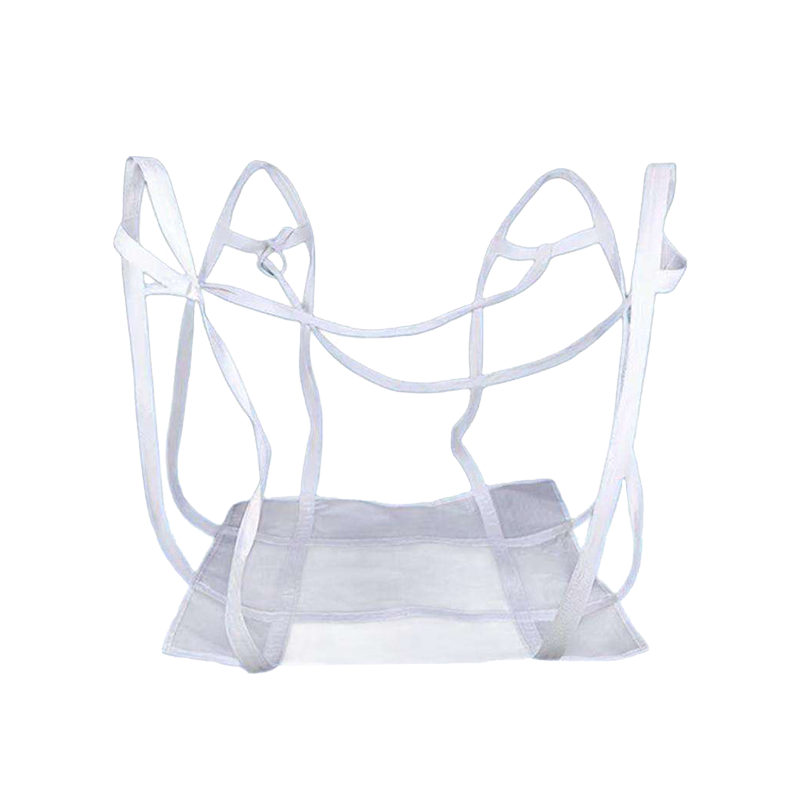

Multi-layer composite weaving technology has become mainstream, with a market share of 68%, significantly enhancing the product’s burst resistance and water resistance, making it suitable for heavy-duty scenarios such as chemical engineering and construction.

The penetration rate of fully automatic circular looms, intelligent printing production lines and other equipment has increased by 22% compared to 2020. After the renovation of a certain factory in Jiangsu Province.

Market differentiation intensifies: Leading enterprises control 38% of production capacity

The industry concentration is accelerating. The combined production capacity of the top 10 enterprises accounts for 38% of the national total, while small and medium-sized enterprises are under pressure to carry out environmental protection renovations. Leading enterprises have built competitive barriers through patent layout (China accounts for 54% of the global patent applications in the woven bag field), intelligent transformation and green certification, achieving a 35% premium space in the high-end markets of Europe and America. For regional manufacturers, focusing on niche markets has become the key to breaking through. Functional products such as anti-mold and antibacterial bags suitable for fresh food cold chain and lightweight bags for e-commerce have seen a growth rate of 13.5%, far exceeding the industry average.

Future outlook: Green supply chain becomes the core of competition

Industry experts point out that in the next five years, the industry will present the characteristics of “regularized environmental protection, popularized intelligence and high-end products”. Enterprises need to focus on areas such as the research and development of carbon footprint labels and the efficient utilization of recycled materials. At the same time, they should pay attention to emerging markets in Southeast Asia and South Asia. The demand in these regions is expected to reach 11.5 billion square meters in 2025, with an annual growth rate of over 8%. As Yu Ansheng, the chairman of Henan Weihua Packaging, said, “The full-chain greening from material research and development to production management will be the key for enterprises to seize the next-generation market.”